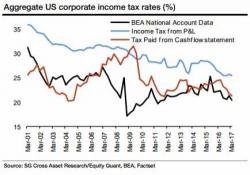

SocGen: "Every Bit Of Good News - Including Tax Reform - Is Now Priced In"

The global stock market is just a few days from entering the history books, largely thanks to the constantly priced in tax reform. As SocGen calculates, and barring any end of year sell-off, the MSCI World index is set to record it first ever year of posting a positive total return in every single month and will hit a remarkable sequence of 14 months of positive returns.