"Somebody" Propped the Markets Up Again Yesterday

At this point the manipulations are getting ridiculous.

“Someone” decided to step in a prop up stocks yesterday. How do we know it was a market prop and not real investors?

There were several “tells.”

They were:

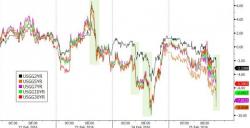

1) The jump in stocks was based on a sudden move in one of the key asset classes the PPT are using to prop up the markets (they are: Oil, the VIX and Yen).

2) The price action was sudden and vertical: neither are the hallmarks of actual buyers.

3) The trading session differed dramatically from recent other sessions.