Is A Stronger Euro And A Stronger Yen In Play?

Submitted by Eric Bush via Gavekal Capital blog,

Submitted by Eric Bush via Gavekal Capital blog,

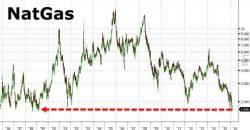

More "unequivocally good" news. On the heels of a smaller than expected drawdown in natural gas inventories (-117 vs -135bcf), Nattie futures have tumbled to their lowest intraday level since 1999...

And while the oil market is "glutted," some are arguing the NatGas market is even more so...

OilPrice.com's Nick Cunningham warns, while the glut in oil is expected to continue for the next year or so before balancing in late 2016, the pain for liquefied natural gas (LNG) could be just beginning...

Russia wants to sell some bonds and President Obama isn’t happy about it.

Moscow is looking to issue “at least” $3 billion of foreign bonds in what amounts to the country’s first international issuance since the West imposed sanctions on The Kremlin in 2014 after the annexation of Crimea and Russia’s alleged role in “destabilizing” Ukraine (because it was very “stable” before).

We have joked about it in the past: with equities around the globe all correlating tick for tick with the price of oil (supposedly "lower oil is good for the economy", just don't tell that to the stock market), instead of doing piecemeal interventions and monetizing stocks, something which as even Citigroup has noted no longer works, what central banks should do instead is monetize the source of all market problems: oil itself.

We first joked last January that the ECB should do it...

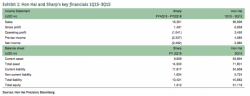

For a minute, Sharp was saved.

The 100-year-old maker of LCD screens was once a consumer electronics powerhouse but has stumbled in the face of fierce price competition and ill-advised investments in advanced production plants. Earlier this month, Sharp reported a net loss of $208 million for for its fiscal Q3, bringing the nine month loss to nearly a billion as the company continues to lose market share to Samsung, LG, and other Asian competitors.