A Tale of Two Crashes, Part 1

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

A Tale of Two Crashes, Part 1

Written by Jeff Nielson (CLICK FOR ORIGINAL)

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

A Tale of Two Crashes, Part 1

Written by Jeff Nielson (CLICK FOR ORIGINAL)

Yesterday, during his speech at CERAWeek in Houston, Saudi oil minister Ali al-Naimi made it explicitly clear that Saudi Arabia would not cut production, instead saying that it is high-cost producers that would need to either "lower costs, borrow cash or liquidate” adding that there is "no need for cuts as marginal barrel will get out of the market." He was right.

"Everybody should be worried.. and be prepared," warns legendary investor Jim Rogers, as he sees the market "facing a bigger collapse than in 2008," and the central banks will be unable to kick the can much longer. "This is the first time in recorded history where you have Central Banks & governments setting out to destroy the people who save & invest," Rogers exclaims and "the markets are telling us that something is wrong - we're getting close."

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

When a currency peg breaks, it unleashes shock waves of uncertainty and repricing that hit the global financial system like a tsunami.

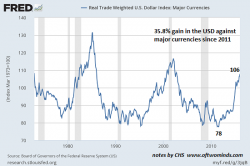

The U.S. dollar has risen by more than 35% against other major trading currencies since mid-2014:

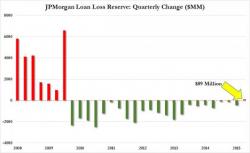

On Tuesday, we got the answer (or at least a partial answer) to the question we posed last month when we asked the following: “How long before the impairments and charges currently targeting smaller firms finally shift to the bigger ones? And how underreserved is JPMorgan for that eventuality?”