Financial Time Bombs Hiding In Plain Sight

Submitted by David Stockman via Contra Corner blog,

Submitted by David Stockman via Contra Corner blog,

Denmark just took a major step to eliminate food waste by opening their first ever food surplus supermarket. The store called Wefood opened in the capital city Copenhagen and will sell produce at prices 30 to 50 per cent cheaper than normal supermarkets. The Independent reports: Per Bjerre from the NGO behind the market, Folkekirkens Nødhjælp, said: “WeFood is the first supermarket of its kind in Denmark and perhaps the world as it is not just aimed at low-income shoppers but anyone who is concerned about the amount of food waste produced in this country.

While it may not be quite the Vancouver-type feeding frenzy for Chinese money launderers, the US existing home sales market (at least until its inevitable downward revision courtesy of the permabullish NAR) continued to chug higher in January, when the number of existing homes sold rose to a 5.47MM annual rate, up 0.4% from the 5.45MM in December, and the strongest pace since the 5.48MM sold last July, beating expectations of a -2.5% drop; in fact the print was higher than the top estimate in the range. This follows the torrid December surge when existing homes sales soared 12.1%.

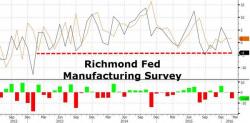

With the biggest drop in New Orders since September, Richmond Fed Manufacturing survey dropped to -4 (missing expectations of +2), hovering at its weakest in over 3 years. Across the board the components were weaker with order backlogs and shipments plunging, average workweek and wages dropping, and capacity utilization worst since October. Prices (paid and received) dropped notably as future expectations for wages, workweek, and employees all fell.

Richmond Fed hovers near 3-year lows

Driven by a collapse in 'hope' - future expectations dropped to 78.9, the lowest since Feb 2014 - The Conference Board's Consumer Confidence headline dropped from 97.8 to 92.2, the weakest since July 2015. Amid the so-called best jobs market in decades, near-record low gas prices, and a resurging stock market, it appears the 'everyday American' is not amused as all the 'increases in animal spirits' since QE3 have evaporated.

Consumer Confidence is hovering near 3 year lows... erasing all the gains since QE3 was initiated