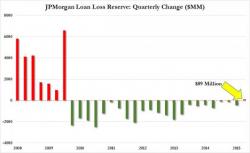

JPMorgan Just Sounded a $500 Million Alarm Bell On America's Dying Oil Patch

Back on January 14, we noted that JPMorgan did something they haven’t done in 22 quarters: the bank increased its loan loss provisions.

The "reserve build of ~$100mm [is] driven by $60mm in Oil & Gas and $26mm in Metals & Mining within the commercial banking group,” the bank said.