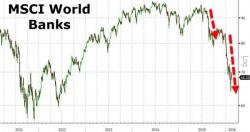

"Private Capital Is Running Away From Trouble"

By Keith Dicker of IceCap Asset Management

Journey to the Center of the Earth

Question: Why is the world in an economic funk?

Answer: Private Capital is running away from trouble

Chart 2 shows two variables. The BLUE line shows the amount of quantitative easing or money printing in the USA. Up until September 2008, the amount of money made available to the economy increased in a gradual manner. Thereafter it became a gong show.