For These Four States, The Recession Has Arrived

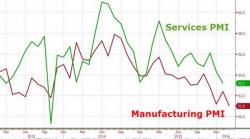

“The industrial environment is in a recession - I don’t care what anybody says,” Fastenal CFO Daniel Florness exclaimed in frustration back in October when William Blair analyst Ryan Merkel dared to suggest that the US economy wasn’t in fact in the doldrums on the company’s Q3 call.