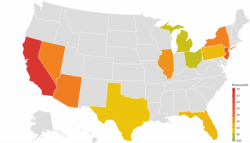

Here Are The States With The Highest Household Debt Burdens

Americans are in debt. And massively so.

In fact, the US is laboring under $1.1 trillion in auto loan debt and $1.3 trillion in student loan obligations.

This massive burden may well be holding back the beleaguered consumer in the US, a country which depends on consumer spending for three quarters of economic growth.