US Oil Rig Count Collapses At Fastest Rate In A Year

Rig counts dropped for the 9th straight week but for the 3rd week in a row, US oil rig counts dropped heavily, down 26 this week after -28, and -31 in the last 2 weeks. The 85 rig drop is a 17% plunge over 3 weeks - the fastest pace since Feb 2015, and 2nd fastest since Feb 2009.

- U.S. OIL RIG COUNT DOWN 26 TO 413, BAKER HUGHES SAYS

- U.S. TOTAL RIG COUNT DOWN 27 TO 514 , BAKER HUGHES SAYS

Rig counts continue to track the lagged crude price perfectly...

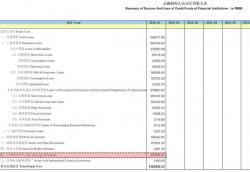

Here is the regional breakdown: