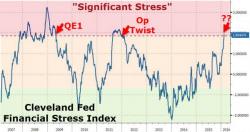

Fed Financial Stress Index Points To "Significant" Market Instability

The Cleveland Fed Financial Stress Index has been rising all year and just broke out to what The Fed describes as a "significant stress" period. The last two times this level of financial instability was breaking out across US markets Bernanke unleashed QE1 (Q1 2009) and Operation Twist (Q1 2012).

"Significant Stress" has been reached...