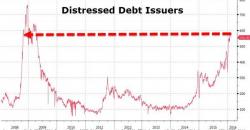

"Worst Since Lehman"

If "everything's fixed," then why is the number of distressed debt issuers still the highest "since Lehman."

h/t @mattmiller1973

And the answer is not - it's just energy and it's different this time.

If "everything's fixed," then why is the number of distressed debt issuers still the highest "since Lehman."

h/t @mattmiller1973

And the answer is not - it's just energy and it's different this time.

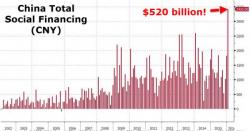

One of the more stunning economic updates this week was China's unprecedented surge in Chinese loan creation, when as reported earlier this week, China unveiled a whopping CNY3.42 trillion in Total Social Financing, its broadest debt aggregate, an amount greater than half a trillion dollars, of which CNY2.51 trillion was in new bank loans.

Originally posted Op-Ed via The Wall Street Journal,

These are strange monetary times, with negative interest rates and central bankers deemed to be masters of the universe. So maybe we shouldn’t be surprised that politicians and central bankers are now waging a war on cash. That’s right, policy makers in Europe and the U.S. want to make it harder for the hoi polloi to hold actual currency.

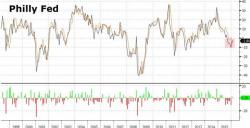

While jobless claims look rosy, Philly Fed's employment index plunged by the most since May 2013 as the headline survey extended its period of sub-50 contraction to six straight months - the longest streak outside of a recesssion in history. Across the board the underlying components were weak with current all tumbling led a collapse in average workweek, employment, and new orders. Worse still, the "hope" index plunged to its lowest since Nov 2012.

6 straight months of contraction flash red for recession...

For all the euphoria about the proposed OPEC oil production freeze deal, the reality is that nothing has been actually decided. As readers will recall, the only "decisions" agreed to between the Saudi and Russian oil ministers were to cap production at already record high levels of output, however contingent on everyone else voluntarily joining said production cap.