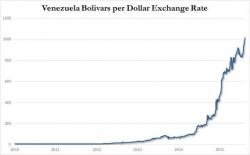

Venezuela Devalues Currency By 37% As Maduro Announces 62-Fold Increase In Gasoline Prices

Maybe because between the specter of defaulting in under three months, the threat of handing over its gold to Deutsche Bank, or the reality of rampant hyperinflation and a collapsing society, the already crushed population of Venezuela did not have enough things to worry about, moments ago Venezuela's Nicolas Maduro unveiled a double whammy of "shock and awe" when the socialist president not only announced the latest devaluation of the country's official currency, but also presented his countrymen with the first gasoline price increase since 1996.