Market Euphoria Fizzles As USDJPY Resumes Slide; Crude Disappointed By Lack Of Production Cut

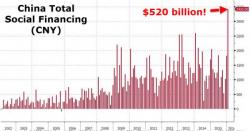

One day after markets saw a violent return of optimism, which sent stocks around the globe and US equity futures soaring (the US was closed for President's Day) driven by terrible Japanese and Chinese economic data which in turn hinted at more central bank easing, animal spirits have cooled off despite some truly unprecedented Chinese credit numbers.