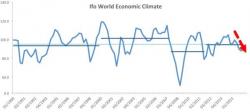

World Economic Climate Index Tumbles

Submitted by Constantin Gurdgiev via True Economics blog,

Global growth leading indicators are screaming it, Baltic Dry Index is screaming it, PMIs are screaming it, BRICS are living it, and now Ifo surveys are showing it: global economy is heading into a storm.

The latest warning is from the Ifo World Economic Climate Index.

Per Ifo release: