In Unexpected Twist, Oil Exporters Are Buying Treasurys While They Liquidate Stocks

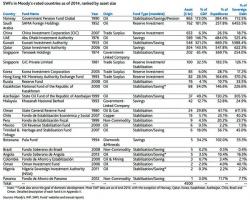

Long before the mainstream media caught on to the topic of SWF selling of stocks, we warned a month ago that as a result of the collapse in oil, and assuming oil remains priced at roughly $31 per barrel, the world's largest SWFs showin the chart below...

... would be forced liquidate at least $75 billion in equities and the lower the price of oil goes, the more selling there would be.