"Killer Wave" Confirms Big Bear Market Looms

Excerpted from James Stack's InvesTech.com,

Technical Evidence: Confirming a bear market

Excerpted from James Stack's InvesTech.com,

Technical Evidence: Confirming a bear market

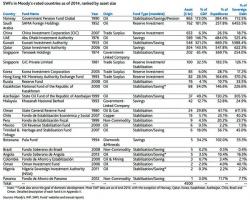

Long before the mainstream media caught on to the topic of SWF selling of stocks, we warned a month ago that as a result of the collapse in oil, and assuming oil remains priced at roughly $31 per barrel, the world's largest SWFs showin the chart below...

... would be forced liquidate at least $75 billion in equities and the lower the price of oil goes, the more selling there would be.

Oil's late week surge provided much buying excitement asd Mid-East equity markets opened with flashing green numbers across every screen. However, by the close, it was a sea of red with Kuwait, Egypt, Amman, and Iraq all lower and Saudi's Tadawul All Share Index tumbling almost 4% from the opening highs as war worries dragged The Kingdom's stock market back near 5-year lows.

Not "off the lows"...

Tumbling near 5-year lows...

As Saudi Bank risk begins to rise once again...

Submitted by Claire Bernish via TheAntiMedia.org,

In the spirit of the transparency — of which the Obama administration claims to be a champion — there will be no details regarding the allocation of non-military intelligence spending in the president’s final budget request to Congress.

For the past two years, while largely nonchalant with broader price levels, the Fed has been warning about two particular asset bubbles: that of easy lending particularly in junk bond, and of a commercial real estate bubble. Following the recent rout which has seen the biggest HY selloff since the financial crisis, especially in the energy sector, it is safe to say that the junk bubble has burst - the only question is how much worse it will get before it bottoms (UBS had some unpleasant thoughts on that matter).