Banking On A Bounce? Jamie Dimon Vs The Credit Market

The buzz surrounding the late-afternoon bounce in stocks yesterday revolved around the news that Jamie Dimon was buying 500,000 shares of JPMorgan Chase stock. As Dana Lyons notes,

The buzz surrounding the late-afternoon bounce in stocks yesterday revolved around the news that Jamie Dimon was buying 500,000 shares of JPMorgan Chase stock. As Dana Lyons notes,

By EconMatters

Apple has a lot further to go to the downside as a stock. This stock will be putting in lower highs and lower lows for years to come.

https://www.youtube.com/watch?v=rAcmJGM9XHc

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

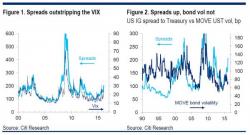

There are market crashes and then there are market crashes: by contrast to August 24, when the S&P500 melted down before our eyes in a sharp, violent plunge as something clearly broke in the link between ETF and vol models and the VIX itself did not report updates for nearly an hour for reasons that have still not been clearly explained, the recent global market crash has been far more contained, if not outright orderly.

After repeated warnings about China's soaring non-performing loans on this site (here, here and here), which have underscroed the basis of Kyle Bass' "big trade for 2016", namely shorting China's currency in the bet it will have to massively devalue in order to address its incipient default cycle, virtually everyone is aware that China has a big Non-Performing Loan problem, a problem whose size we first quantified as much as $3 trillion, or the same amount as all of China's FX reserves.

Submitted by Dalan McEndree via OilPrice.com,