Weekend Reading: Bull Struggles & NIRP

Submitted by Lance Roberts via RealInvestmentAdvice.com,

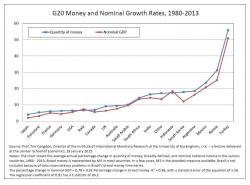

Wow…things are certainly happening faster than I expected. As January kicked off the new year, I posted my outlook for 2016 in which I discussed why, despite views of Goldman Sachs and many others, interest rates were going lower rather than higher.