Don't Show Bill Dudley This Chart

The Fed's Bill Dudley just unleashed the most cognitively dissonant statement of his career. That superlative is highlighted by theses two headlines:

- DUDLEY SAYS U.S. ECONOMY IS IN QUITE GOOD SHAPE

- DUDLEY: DON'T SEE NEGATIVE RATES HAVING 'BIG CONSEQUENCE'

Try telling The BoJ's Kuroda that!!

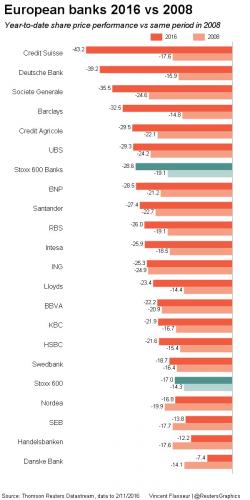

Nope - no consequence at all...

Yet again his comments confirm The Fed's utter confusion...

Today: