The Curious Case Of The "Strong" January Retail Sales: It Was All In The Seasonal Adjustment

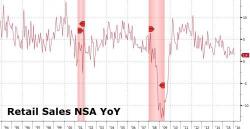

There was hardly a blemish in today's retail sales report: the January numbers not only beat expectations across the board, including the all important control group which printed at 0.6% or the highest since May, but the December data was also revised notably higher. At first glance, great news for those who hope consumer spending is finally getting some traction from collapsing gasoline prices.

And yet, even a modestly deeper look below the strong retail sales headline numbers once again reveals just how this "across the board beat" was accomplished.