It Was Never About Oil

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Submitted by Jeffrey Snider via Alhambra Investment Partners,

Is this what they call a "trust fall"?

Submitted by Lance Roberts via RealInvestmentAdvice.com,

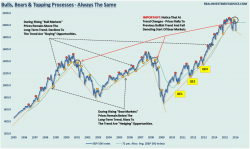

In this past weekend’s newsletter, I discussed the formation of a very important “head and shoulders” topping pattern in the market.

I know…I know. As soon as I wrote that I could almost hear the cries of the “perma-bull” crowd exclaiming “how many times have we heard that before.”

The on-the-run WTI crude futures price just plunged to $27.27 (for the March contract) which is a new cycle low for black gold (below March's previous "This is the low" lows in January.) It should not be entirely surprising since US Energy credit risk has spiked once again to new record highs.

Oil hits new cycle lows...

As even investment grade emergy credit risk spikes to record highs...

The real swarm of bankruptcies has yet to begin but CHK will be the first biggest test.

Ever since the unexpected gating and liquidation of Third Avenue's credit fund in early December, there has been a jump in comparable credit money managers, both of the mutual and hedge fund variety, such as Claren Road and Stone Lion Capital, who have decided they'd rather hand in the keys and repay their investors (at a loss) than try to eek out alpha in an environment where, as Richard Breslow put it earlier, "it feels like the algos are hooked up to Tinder."