Submitted by Jeffrey Snider via Alhambra Investment Partners,

The link between stock prices and oil has been especially high of late, and that has left quite a few traders and experts stumped. For a good long while any impact from oil was denied as only “transitory” or even helpful to consumers through some sort of “tax cut” effect. In January 2016, however, liquidations appeared regularly in one alongside the other. This is/was not supposed to occur. From last month:

“Absent an economic recession, stocks have fallen too far in my mind as a long-term investor,” says John Buckingham, who manages about $600 million as chief investment officer of Al Frank Asset Management…

“It’s a big move, and the sentiment in crude is driving pretty much all asset classes right now,” said Brett Mock, managing director at brokerage JonesTrading Institutional Services LLC.

Again today, stocks sold precipitously (in the morning) while oil crashed, as if there might be some common monetary theme behind all the liquidation efforts. It has left even the most veteran stock watchers as reluctant petroleum analysts still wondering why so much crude supply could be so devastating.

“It’s the oil tail wagging the market dog ,” said Art Hogan, chief market strategist at Wunderlich Securities.

That has left the “market” seemingly in desperation for the Fed to come back and save stocks as so many believed had happened before.

“There could be some growing optimism ahead of Janet Yellen’s testimony. She has in the past had the ability to push markets higher, although that’s diminished in recent years,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

It’s a nice fairy tale, but the very fact that stocks and oil are where they are suggests the Fed hasn’t been effective at all; particularly since all anyone will talk about is a looming recession contradicting everything monetary policy has described or promised. In fact, the entire idea of the “Greenspan” put, updated from Bernanke to Yellen, never materialized. When needed, when the market was most pressed, the Fed failed – spectacularly. And 2008 was not the first as this century has already witnessed just 15 years in two 60% declines in stocks (for the S&P 500; worse in other segments/indices).

What clouds the issue of monetarism is the difference between them. The dot-com bust was just as severe and in many ways more painful (the Chinese torture of slow erosion of the first versus the much faster and immediately violent crash of the most recent) but there was no great recession with it, only mild economic discomfort. Alan Greenspan and his committee of the orthodox faithful had been given a lot of credit for “guiding” the economy through that period with minimal damage. The fact that it was “achieved” via a massive housing bubble was only later appended to the narrative as if still a backhanded acknowledgement of monetary power and authority.

Even that still gives the Federal Reserve and monetary policy too much credit. We know this for sure because both Alan Greenspan and Ben Bernanke told us; and contemporarily. In Greenspan’s words it was a “conundrum” while Bernanke posited a “global savings glut.” Both are the same interpretation of a monetary system far out of alignment with not just economics but even central bank policy. The context of both those ridiculous theories holds the dispostive interpretation – the FOMC was attempting to “tighten” monetary policy but the “conundrum” and “global savings glut” showed that the true monetary system was having none of it.

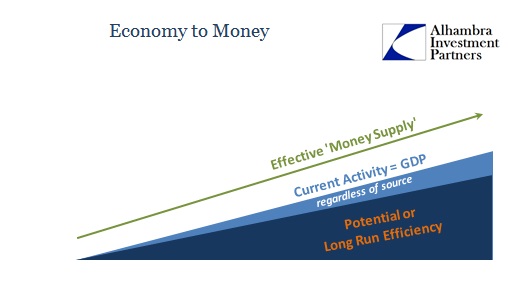

The relationship of money to economy is supposed to be robust and highly conducive as a tool for increasing efficiency. In the past, the mechanism guiding that relationship was hard money in the form of metal (gold or silver). Economists of the Progressive Age judged that unreliable and proceeded to undo as many hard money constraints as possible – giving us the Great Depression as their first step.

While the Bretton Woods standard had lasted until 1971, in truth it had come undone as early as the late 1950’s. The US, for instance, had actually removed the gold exchange mechanism as early as 1960 in the London Gold Pool. When gold was finally banished officially, ostensibly the dollar was believed its replacement, but it wasn’t as if the global stash of “reserves” of physical Federal Reserve Notes were its basis. The dollar system that came to create global trade liquidity and finance was credit-based, a distinction that makes all the difference.

Despite that fact, very few seem to stand in appreciation of what it meant then; and fewer still now. The Fed, for one, with its monetarist orthodoxy believes that recession is everywhere unhelpful and thus tries to influence the money supply via a federal funds rate. In the dot-com bust and recession, they brought the rate down to as low as 1%; and that was almost two years after it was over. Again, that provides another clue as to whether theory matches actual conditions.

The point of recession in the first place is to temporarily deviate in order to remove inefficiency; the necessary pruning of creative destruction. In terms of money supply, under hard money systems that meant actually tighter money conditions where interest rates rose and asset prices fell. These were, like economic recession, true market forces trying to re-establish more toward the foundation baseline – to maintain that solid, “strong dollar” relationship between money and economy.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-Recession.jpg[/image]

In the dot-com recession, however, stock prices declined severely but really nothing else did – as if the money supply factor had been unperturbed at all. That wasn’t as much of a difference as it might seem, given that as early as 1996 Alan Greenspan was speaking about monetary correlations gone awry. His “irrational exuberance” speech was really about that point. It was the eurodollar standard becoming a fully bloomed parallel banking system as it both supplied funding (“dollars”) and pushed credit and debt for offshore and now onshore capacities.

The Fed taking no note or concern over the eurodollar at all, aside from M3 calculating, insisted that monetary policy be driven by the consumer inflation rate as translated into economic potential via still the Phillips Curve. Thus, if consumer inflation was low, then current activity was believed at least near enough to economic “potential” no matter the other true factors.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-Recession-Bubbles.jpg[/image]

In reality, the active and comprehensive “money supply” was simply exploding – so much so that it barely noticed the dot-com bust and therefore produced almost nothing of the recession. It certainly did not signal the usual “tight money” conditions that accompany the more robust relationship with the economic foundation. This was the serial asset bubbles that were really larger than any single expression of them.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-dot-com-Housing.jpg[/image]

The relationship between money supply growth and economy became truly tenuous during the housing mania of the middle 2000’s. The reason was simply that asset bubbles (inflation) are highly inefficient and so produce great imbalances in the liquidity and monetary structures that link money to economy. Banks were making money in money dealing activities based solely on the premise that the entire system could and would continue expanding on that insane baseline as if permanent; and if it were ever interrupted by recession, as 2001, then that would be a trivial and temporary deviation.

This was the outlook of not just global banking but monetary policy and orthodox economics. Thinking that consumer inflation supplied all the necessary information about the state of money as it related to economic potential, neither central banks nor economists were prepared for what hit on August 9, 2007, and everything thereafter. To monetary policy and economic theory derived from the Phillips Curve, there could not have been “too much money” and the recession should not have been very large at all. In fact, that was the scenario that every single one of their models kept suggesting deeper and deeper into it.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-GR.jpg[/image]

Thus, they were wholly surprised and unprepared for not just the size and scale of deterioration money and economy, but that it could have happened at all. The decrepit recovery thereafter similarly confounds, but it reveals to the awakened monetary sense of the credit-based reserve currency a singular truth about the US and global economy: it has shrunk. It’s not that the recession in 2008 and 2009 performed that act, but more so that it revealed the destruction in economic potential from the monetary misalignment dating back a long, long time.

We know without doubt that is the case because you can’t simply lose 15 million potential workers and suggest anything else; only a shrunken economy would so significantly diminish in labor utilization.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-GR-Shrunk.jpg[/image][image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/ABOOK-Feb-2016-Payrolls-Unem-Rate-Emp-Ratio-Longer.jpg[/image] [image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/ABOOK-Feb-2016-Payrolls-Unem-Rate-Part-Rate.jpg[/image]

In other words, even though GDP was positive and appearing somewhat like a lackluster recovery during the housing bubble, that was only masking the erosion in economic potential via what Austrian economists call malinvestment – and on a grand scale.

That is why central bankers responded as they did, both in terms of heavy size of intervention and the single goal of them. They thought the GR was just another cycle only far larger, therefore their task was to remove any financial or monetary impediments such that the global economy would find its way back to the 2005 baseline. It never did, nor did any of these trillions in “money printing” create much if any “inflation” which was supposed to be one of the primary mechanisms restoring full growth (as believed by orthodox economists). In fact, no matter what or how insane and ridiculous, central bank policy appears only more and more ineffective as if no matter what they do a larger and more basic dynamic supersedes all of it.

It has left us with an intermittent battle of up, down, up, down, with central banks having to repeat these massive operations over and over. And in the failure of each one they are left wondering what happened.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-GR-Aftermath.jpg[/image][image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/ABOOK-Feb-2016-PCE-Deflator-Fed-BS.jpg[/image]

Through all of them, the economy at most responds temporarily before slumping “unexpectedly” each time. In viewing each episode narrowly as if a contained whole or even just singular factors within them, the big picture of sound money and sound economy can get lost. Focusing too much on the exact nature and structures of growing illiquidity and “deflation”, via market crashes and currency disruptions, can have the same effect. In other words, those are just the mechanisms for deeper market forces trying to resolve that primary imbalance that was left unanswered even after the Great Recession and Panic of 2008.

[image]https://www.alhambrapartners.com/wp-content/uploads/2016/02/SABOOK-Feb-2016-Never-About-Oil-Money-to-Economy-GR-Eurodollar-Decay-1.jpg[/image]

The money supply, for lack of a more appropriate term in the “dollar’s” universe, is in the long run converging with the shriveled economic baseline. The immediate problem for our current circumstances is that we don’t yet have any idea what that foundation might look like even now- how far is down.

What we do know is that the eurodollar system is failing and we know how it is failing. From negative swap spreads to the shrunken, depressed money and credit curves, they all spell out the death of the current standard. In that sense, “death” may be too strong a term since that isn’t necessarily the end point (I find it unlikely that the eurodollar can continue as it is, but that isn’t impossible if perhaps reduced enough to some rump resource function). Money is via market forces now almost fully stripped of its artificial nature, whatever was left of the pre-crisis expectations and orientations, leaving only that bedrock of actual potential for support however desiccated it may be now.

Oil prices, among other indications, suggest perhaps much worse than we would like on that count. As noted yesterday, money markets, too. Whatever ultimately the case, this has never been about oil prices except that they are the most visible and straddling indication between finance and economy; the money supply attempting a rebalancing in reverse of leverage that once dominated everything but no longer can fix to even slightly stable fashion. It is the representation of the structure behind the seeming cyclical.