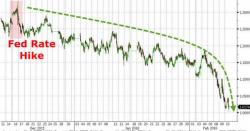

WTI Crude Plunges To New Cycle Lows As Energy Credit Risk Hits Record Highs

The on-the-run WTI crude futures price just plunged to $27.27 (for the March contract) which is a new cycle low for black gold (below March's previous "This is the low" lows in January.) It should not be entirely surprising since US Energy credit risk has spiked once again to new record highs.

Oil hits new cycle lows...

As even investment grade emergy credit risk spikes to record highs...

The real swarm of bankruptcies has yet to begin but CHK will be the first biggest test.