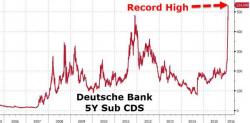

Deutsche Bank Is Back: 5 Year Sub CDS Soar To Record High

"Worse than Lehman" is how one European bond market trader described the carnage this week as the brief respite that ECB monetization and debt-buyback rumors provided yesterday have morphed into utter destruction this morning. European (and US) banks are a sea of contagious red with Deutsche Bank the tip of the collapse spear. Credit risk on Deutsche has exploded this morning with Sub CDS trading up 85bps to a record high 540bps... eerily reminiscent of the pre-Lehman bankruptcy week in 2008.

Time to panic now?