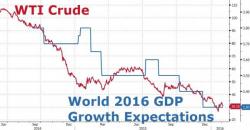

Surging Bank Risk Screams The Rebound In Stocks Is Over

BMO's Mark Steele is a man of few words, preferring pictures to make his points... but they matter:

Let’s just keep it simple. When bank risk breaks to the upside, it’s bad for equities...

European bank risk is breaking out...

which has arrested the pullback in U.S. bank risk - which is now soaring...

And that bodes ill for global stocks...