USDJPY Plunges To 113 Handle - Gives Up QQE2 Gains

Central Banks are losing control everywhere...

Or put another way...

almost there pic.twitter.com/94ZoVKjZNc

— zerohedge (@zerohedge) February 10, 2016

Central Banks are losing control everywhere...

Or put another way...

almost there pic.twitter.com/94ZoVKjZNc

— zerohedge (@zerohedge) February 10, 2016

We can't stop laughing after reading this note from Bloomberg's Richard Breslow for one simple reason: in under 350 words it summarizes everything we have said since our initial "big" article from April 2009, "The Incredibly Shrinking Market Liquidity, Or The Upcoming Black Swan Of Black Swans" in which we predicted how the onslaught of HFT would make a farce of trading at the micro level, and all our posts since then condemning central bank intervention, making a mockery of fundamental analysis at the macro level.

Just as we detailed last week, and it appears Rep. Hensarling has been reading... To wit:

"There are several potentially substantial legal and practical constraints to implementing a negative IOER rate regime, some of which would be binding at any IOER rate below zero, even a rate just slightly below zero. Most notably, it is not at all clear that the Federal Reserve Act permits negative IOER rates, and more staff analysis would be needed to establish the Federal Reserve’s authority n this area."

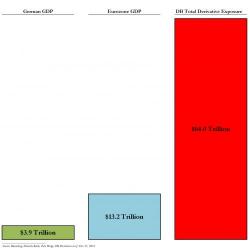

When it comes to government bail outs of insolvent banks few are as qualified to opine as John Mack who was CEO of Morgan Stanley when the bank, along with all other U.S. TBTF banks, was bailed out with a multi-trillion rescue package in the aftermath of the Lehman failure. Which is why it was illuminating, if not surprising, that during an interview with Bloomberg TV discussing the future of Deutsche Bank, John Mack said that "there’s no question in my mind, it is absolutely good for every penny." In other words, "Deutsche Bank is fine."

Following last night's across the board build in inventories from API, DOE reported a surprising 750k drawdown (much less than the 3.2mm build expected). However, across the rest of the complex - inventories rose: Cushing +523 build (13th week in a row), Gasoline +1.26mm build, and Distillates +1.28mm build (first in 4 weeks). Having tumbled early on from Yellen's undovishness, crude spiked on the headline draw (back above $29) but is struggling to hold gains.

From API: