"Bloodbath" In Black Gold - Buffett's Phillips 66 Dumps Oil In Cushing, Crashes Crude Spreads To 5 Year Lows

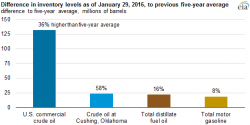

The canary in the coalmine of an increasingly desperate energy industry just croaked. With "unusual timing" and at "distressed prices," Reuters reports that Phillips 66 - the major US refiner owned by Warren Buffett - dumped crude oil for immediate delivery into Cushing storage tonight. This sparked heavy selling of the front-month WTI contract (to a $26 handle) and crashed the 1st-2nd month spread to 5 year lows.