Treasury Yield Curve Plunges To Flattest Since 2007, Financials Follow

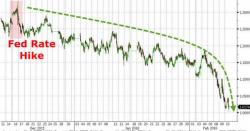

For the first time since 2007, the spread between 2Y and 10Y US treasury yields has to 100bps. While not inverted, which the status quo maintains means there cannot be a recession, the bond market is flashing ominous signs for both the economy and the US financial system...

The curve has collapsed since The Fed hiked rates...

And financials have begun to catch down to that reality...

Charts: Bloomberg