BP's Stunning Warning: "Every Oil Storage Tank Will Be Full In A Few Months"

It was just last week when we said that Cushing may be about to overflow in the face of an acute crude oil supply glut.

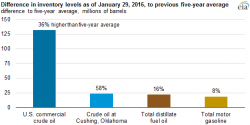

“Even the highly adaptive US storage system appears to be reaching its limits,” we wrote, before plotting Cushing capacity versus inventory levels. We also took a look at the EIA’s latest take on the subject and showed you the following chart which depicts how much higher inventory levels are today versus their five-year averages.