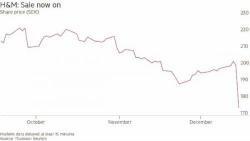

World's Second Largest Clothing Retailer Crashes Most In 16 Years

Shares of Stockholm-based Hennes & Mauritz, better known as H&M, the world’s second largest clothing retailer after Inditex (owner of Zara), crashed 14.8% after reporting an unexpected drop in fiscal 4Q 2017 sales. Sales missed both consensus and company estimates with the resulting fall in H&M’s share price was the steepest intra-day decline since 11 September, 2011.

Source: FT.