A Confused Deutsche Bank Takes To Twitter Seeking Answers For Market Crash

Just when we said DB should probably keep its mouth shut, the bank that everyone is suddenly very focused on decided to take to Twitter with the following rhetorical question:

#DAX dropped below 9,000 points yesterday - worst start to a year ever: are the markets overreacting? #DrStephan

— Deutsche Bank (@DeutscheBank) February 9, 2016

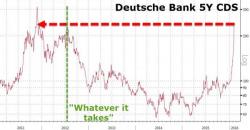

Well, judging by this...

... the markets are probably underreacting.