Bonds & Bullion Best As Dollar Crashes To 4-Month Lows

European bonds are collapsing... systemic risk is rising... US Services economy "pillar" plunges... and jobs data is dismal - stocks shrugged...

European bonds are collapsing... systemic risk is rising... US Services economy "pillar" plunges... and jobs data is dismal - stocks shrugged...

"It's a supply issue", "No, it's a demand issue" - when it comes to the cause for plunging oil prices, the two camps will surely never agree on just what is causing it.

Luckily, Obama may provide just the tiebreaker.

Moments ago, Politico reported that in his final budget, Obama is set to unveil an ambitious plan for a “21st century clean transportation system.” which will be funded by a $10/barrel tax on oil.

Submitted by Simon Black via SovereignMan.com,

It’s news that seems ripped from the pages of The Onion. Or perhaps Atlas Shrugged.

But incredibly enough it’s actually true: earlier this week, Congress proposed a new law authorizing the US Postal Service to provide banking and financial services.

It’s called the “Providing Opportunities for Savings, Transactions, and Lending” Act, abbreviated as… wait for it… the POSTAL Act.

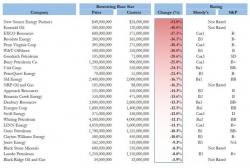

We’ve written quite a bit about US O&G producers’ dependence on capital markets to plug funding gaps.

In short, the entire space is free cash flow negative, which means without access to liquidity, the whole thing falls apart. That, Citi wrote last September, is shale oil’s “dirty little secret.”

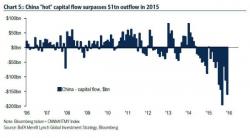

As noted earlier today, BofA's chief credit strategist Michael Hartnett is anything but bullish: in his own words, he remains a seller "into strength in coming weeks/months of risk assets at least until a coordinated and aggressive global policy response (e.g. Shanghai Accord) begins to reverse the deterioration in global profit expectations and credit conditions."