US Investment Grade Credit Risk Spikes To 5-Year Highs

When it rains it pours...

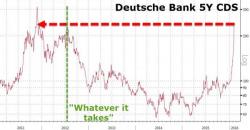

The market has taken over The Fed's role - forget above 25bps here or there, the cost of funding for even the highest quality US Corporates is exploding...

Simply put, the credit cycle has turned and is accelerating rapidly - crushing any hopes for debt-funded shareholder-friendliness.