The Bubble Deflates – And Crash Risk Rises

Submitted by Pater Tenebrarum via Acting-Man.com,

A Harrowing Friday – Momentum Stocks Continue to Break Down

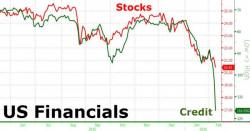

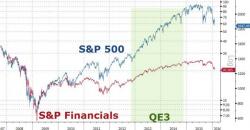

The release of Friday’s payrolls report was the worst of all worlds for the US stock market. This typically happens in bear markets: suddenly fundamental data that wouldn’t have bothered anyone a few months ago are seen as a huge problem. Why was it seen as problematic?