Are The Payroll Jobs Reports Merely Propaganda Statements? — Paul Craig Roberts

Are The Payroll Jobs Reports Merely Propaganda Statements?

Paul Craig Roberts

US economics statistics are so screwed up that they do not provide an accurate picture.

Are The Payroll Jobs Reports Merely Propaganda Statements?

Paul Craig Roberts

US economics statistics are so screwed up that they do not provide an accurate picture.

Be careful what you wish vote for...

Source: Investors.com

Submitted by Jeffrey Snider via Alhambra Investment Partners,

How did the world get this way? I don’t mean the oncoming recession, if that is indeed, as it appears, the economy’s fate. How did the payroll statistics ever attain this kind of deference and even religious zeal?

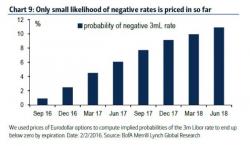

Over one year ago, when the "conventional wisdom" punditry was dreaming up scenarios in which the Fed could somehow hike rates to 3% and in some magical world where cause and effect are flipped, push the economy to grow at a comparable rate we said that not only is the Fed's tightening plan going to be aborted as it represents "policy error" and tightening in the middle of a global recession, but it will result in the Fed ultimately cutting rates back to zero and then, to negative.

Submitted by David Stockman via Contra Corner blog,

Well, they got that right. Detecting that “parts of the U.S. jobs report for January seem fishy”, MarketWatch offered this pictorial summary: