Is The Fed "Seriously Considering" Negative Interest Rates?

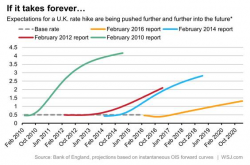

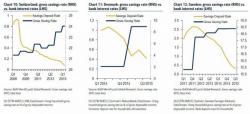

The Fed may "seriously consider" negative rates after moving rates back to zero, reintroducing forward guidance and making "stronger pleas" to Congress for fiscal policy action as there are complications for money markets, according to BofAML strategist Mark Cabana.

This would not be a total surprise as Mises Institute's Joseph Salerno warns recent Fed commentary suggests they want to test-drive negative interest rates...