As US Inflation Expectations Plunge And Converge With Europe's, Here Is One Way To Trade It

By Francesco Filia, CIO of Fasanara Capital

US Inflation Expectations Closing Gap To Europe's

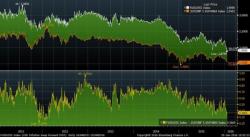

In January, surprisingly, US Inflation expectations, as measured by 5y5y forward inflation swaps, plunged closer to European forward inflation rates (within 10bps from 5yr lows).

In stark contrast, the 5y interest rates spread between US Treasuries and Bunds stands near its 5-yr highs, as the FED expects (and is expected) to raise rates, while the ECB contemplates deeply negative interest rates.