BoJ Preview: "The Need For A Kuroda Bazooka Is Growing"

“These are extremely poor results,” Citi’s Andrew Coombs wrote last week after Deutsche Bank CEO John Cryan announced a “sobering” set of numbers for 2015.

By “sobering,” Cryan meant a net loss of more than $7 billion. It was the first annual loss since the crisis and was capped off by a Q4 loss of €2.1 billion which included €1.2 billion in litigation fees.

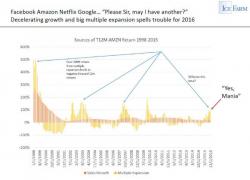

For all the traders and hedge fund managers who are under 30, Amazon has been here before, and not just once: a place where the company's growth prospects - perceived as virtually boundless - were put into question, leading to a collapse in the soaring stock price.

Indicatively, putting the company's "valuation" in context, AMZN is now trading at a PE of roughly 460x, which compares to 87x during the last peak in the summer of 2008.

Submitted by David Stockman via Contra Corner blog,

There is something rotten in the state of Denmark. And we are not talking just about the hapless socialist utopia on the Jutland Peninsula——even if it does strip assets from homeless refugees, charge savers 75 basis points for the deposit privilege and allocate nearly 60% of its GDP to the Welfare State and its untoward ministrations.

For years, shorts would tear their hair out quarter after quarter, when AMZN would continue to bleed cash with relentless abandon, only to see the stock soar after earnings. Now, in what may be a perfect poetic symmetry, following the quarter in which Amazon's free cash flow soared to the highest in years, printing at $7.3 billion, or more than triple the year ago period...

... on margins that are becoming respectable on both a quarterly...

... and LTM basis...

... The stock is crashing by 12% at this moment: