Meet China's Latest $1.8 Trillion "Problem"

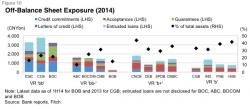

Last summer we outlined how Chinese banks obscure trillions in credit risk.

The powers that be in Beijing aren’t particularly keen on allowing the banking sector to report “real” data on souring loans - especially given the fragile state of the country’s economy. In some cases, the Politburo will pressure banks to simply roll over bad debt, effectively kicking the can.

In addition, banks carry around 40% of their credit risk outside of “official loans.” Here’s what Fitch had to say last year: