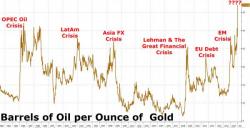

What Crisis Is The Gold/Oil Ratio Predicting This Time?

The number of barrels of oil that a single ounce of gold can buy has never, ever been higher.

For the last 30 years, when the ratio of gold-to-oil spikes, something systemically serious occurs globally (as opposed to the usual bullshit "this is transitory" statements).

So what happens next?