Cracks At The Core Of The Core

Exceprted from Doug Noland's Credit Bubble Bulletin,

Exceprted from Doug Noland's Credit Bubble Bulletin,

A few dots are starting to be connected now that we have exposed the debacle of The Fed's decision to allow banks to mark-to-unicorn their energy loans. "Something" was wrong in recent weeks as the TED-Spread surged (implying rising counterparty uncertainty among banks) and then the last week - since The Fed's alleged meeting with banks - has seen financial credit and stocks crash.

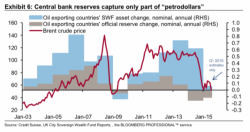

Back in August, we explained why the great petrodollar unwind could be $2.5 trillion larger than anyone thinks.

China’s effort to “control” the glidepath for the yuan devaluation led to a dramatic decline of Beijing’s FX reserves and pushed reserve liquidation to the front of the market’s collective consciousness.

Submitted by Pater Tenebrarum via Acting-Man.com,

Economic Conditions Continue to Worsen

It must be China. Or the weather, which is usually either too cold or to warm – somehow the weather is just never right for economic growth. Surely it cannot be another Fed policy-induced boom that is on the verge of going bust? Sorry, we completely forgot – the Fed is never at fault when the economy suffers a boom-bust cycle. That only happens because we have “too few regulations” (that’s what Mr. Bernanke said after the 2008 bust – no kidding).

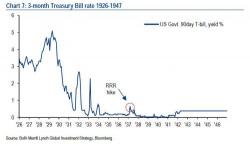

Following an epic stock rout to start the year, one which has wiped out trillions in market capitalization, it has rapidly become a consensus view (even by staunch Fed supporters such as the Nikkei Times) that the Fed committed a gross policy mistake by hiking rates on December 16, so much so that this week none other than former Fed president Kocherlakota openly mocked the Fed's credibility when he pointed out the near record plunge in forward breakevens suggesting the market has called the Fed's bluff on rising inflation.