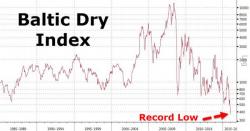

What If The Imploding Baltic Dry Index Does Reflect Global Trade After All

Earlier today, the Baltic Dry Index hit a new all time low.

This is not new: we have been tracking the collapse of the Baltic Dry - aside for the occasional dead cat bounce - to all time lows, a proxy of global shipping and thus trade, for the past 7 years.

To be sure, for staunch goalseeking Keynesian the collapse in Baltic Dry rates had little to do with actual demand for this services, and everything to do with the alleged supply of drybulk shipping, which was the stated reason for the collapse in costs.

In other words, "trade was fine."