Published

2 hours ago

on

August 5, 2025

| 4 views

-->

By

Julia Wendling

Graphics & Design

- Zack Aboulazm

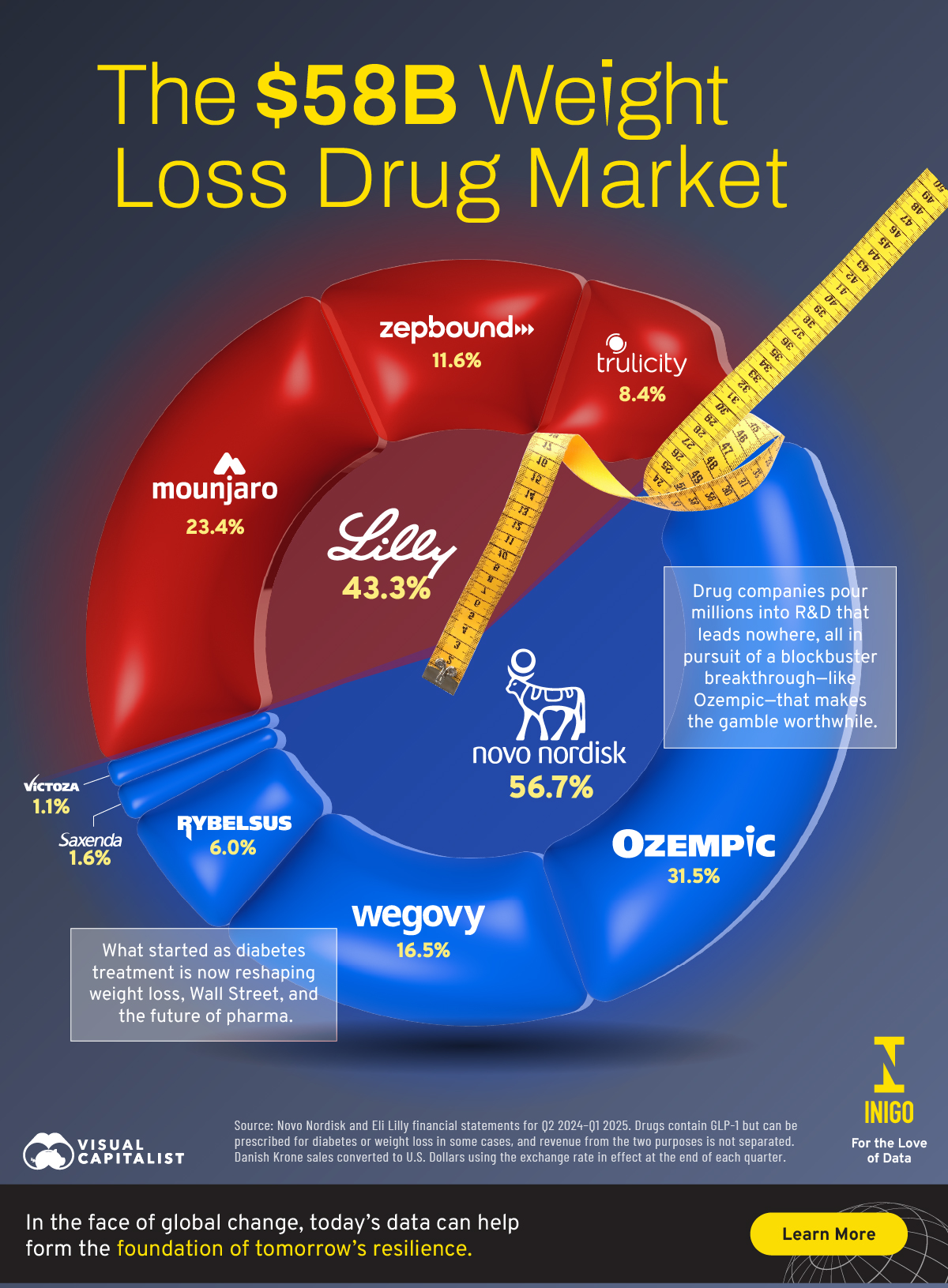

The $58B Weight Loss Drug Market in One Chart

Weight loss drugs have surged in popularity in recent years, transforming the pharmaceutical landscape. Companies leading the charge in GLP-1 development are reaping massive financial gains and wielding growing influence.

This visualization, created in partnership with Inigo Insurance, highlights the top brands dominating the $58 billion weight loss drug market—and the powerhouse companies driving their success.

What Are GLP-1 Drugs?

GLP-1 drugs have dominated headlines in recent years—but what exactly are they?

These medications mimic the hormone glucagon-like peptide-1, which helps regulate blood sugar and appetite. Originally developed to treat type 2 diabetes, they have become popular for weight loss because they slow digestion, reduce hunger, and promote feelings of fullness.

Ozempic, Mounjaro, Wegovy, and More Weight Loss Brands

In the U.S., roughly 1 in 8 adults (12%) have tried GLP-1 drugs, and 6% are currently using them. These medications have become mainstream, with brands like Ozempic and Mounjaro now household names. The rapid ascent of these drugs has propelled metabolic treatments into a leading position in the R&D pipeline.

Despite the range of brand names, the market is dominated by just two companies: Eli Lilly in the U.S. and Denmark’s Novo Nordisk. Novo Nordisk leads with Ozempic, which commands nearly one-third of the market (31.5%), followed by Eli Lilly’s Mounjaro at 23.4%.

| Drug Name | Company | Share of Total |

|---|---|---|

| Ozempic | Novo Nordisk | 31.5% |

| Mounjaro | Eli Lilly | 23.4% |

| Wegovy | Novo Nordisk | 16.5% |

| Zepbound | Eli Lilly | 11.6% |

| Trulicity | Eli Lilly | 8.4% |

| Rybelsus | Novo Nordisk | 6.0% |

| Victoza | Novo Nordisk | 1.1% |

| Saxenda | Novo Nordisk | 1.6% |

The remaining share is split among other brands owned by these same companies. For Novo Nordisk, Wegovy holds 16.5% of the market, Rybelsus 6.0%, Saxenda 1.6%, and Victoza 1.1%. Eli Lilly’s portfolio also includes Zepbound with 11.6% and Trulicity with 8.4%.

A Risky Dynamic

When two companies dominate an entire drug category, market concentration creates both opportunity and vulnerability. While Eli Lilly and Novo Nordisk benefit from pricing power and the financial resources to push innovation further, they also have the potential to face regulatory scrutiny and patent challenges.

Explore Inigo’s Hub.

You may also like

-

Healthcare1 week ago

Mapped: Measles Cases by State in 2025

See how measles cases are spread across the U.S. in 2025, with Texas reporting over 700 cases amid falling vaccination rates.

-

Healthcare1 week ago

Charted: The Biggest Threats to Teens’ Mental Health

Both parents and teens see social media as the top threat to teen mental health.

-

Healthcare2 weeks ago

Visualized: America’s Surge in Measles Cases in 2025

U.S. measles cases in 2025 have already surpassed 2019’s high levels, making it the worst measles outbreak since 1992.

-

Maps2 weeks ago

Mapped: Health Insurance as a Share of Median Income by U.S. State

Americans pay wildly different amounts for health insurance depending on where they live.

-

Cannabis3 weeks ago

Charted: The World’s Most Widely Used Psychoactive Drugs

Three-quarters of users are men, though women face higher health risks.

-

United States1 month ago

Charted: U.S. Pharmaceutical Drug Imports from China

Around 90% of medicines prescribed in the U.S. are imported, and China is a major supplier.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up