PBOC Injects Massive $60 Billion Liquidity - Most In 3 Years

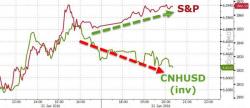

Offshore Yuan is sliding lower after its "US equity market saving" surge during the day session as PBOC fixes Yuan stable for the 10th day in a row. Despite the smoke and mirrors of stability however, they injected a colossal 400 billion Yuan into the financial system - the most in 3 years.

Offshore Yuan is sliding...

PBOC holds Yuan Fix stable for the 10th day with a very small weakening:

- *CHINA SETS YUAN REFERENCE RATE AT 6.5585 AGAINST U.S. DOLLAR