It Is Now Cheaper To Rent A Dry Bulk Tanker Than A Ferrari

China’s slowing growth has crushed shipping rates to such an extent that hiring a 1,100-foot merchant vessel would set you back less than the price of renting a Ferrari for a day.

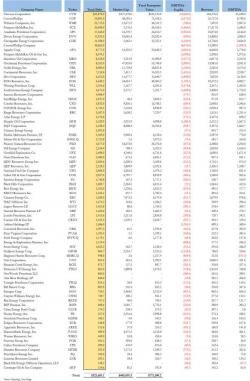

As Bloomberg reports,