Former IMF Chief Economist Warns "If Stock Slump Lasts Longer, Will Become Self-Fulfilling"

Submitted by Olivier Blanchard via The World Economic Forum,

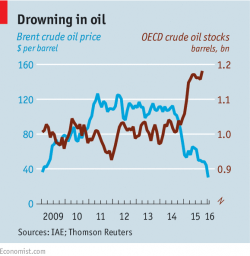

The stock market movements of the last two weeks are puzzling.

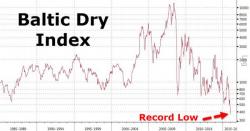

Take the China explanation. A collapse of growth in China would indeed be a world-changing event. But there is just no evidence of such a collapse. At most, there is suggestive evidence of a mild slowdown, and even that is far from certain.