Global Markets Slide, US Futures Wipe Out Overnight Gains In Volatile Session

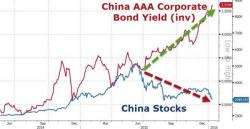

It has been another choppy, illiquid, volatile overnight session, which started with weakness out of China, whose Shanghai Composite dropped 20% into another bear market in early trading, then further slammed by news of a terrorist attack in Jakarta, only to rebound back over 3000 as the Chinese National Team decided to intrevene again, this time in the ChiNext small cap index, pushing it higher by 5.6%.