Scorching Demand For 10 Year Paper: Indirects Take Down Near Record 71%, Bid To Cover Surges

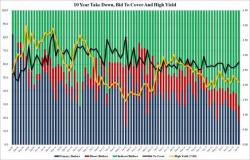

If anyone had expected that today's record AB InBev deal would lead to a tail in the just concluded $21 billion 10-Year (technically 9 Year-10 month CUSIP M56 reopening) auction, they would be very disappointed, when moments ago the US Treasury announced a high yield of 2.09%, stopping a whopping 1.5 bps through the When Issued 2.105%, and the lowest yield since October's 2.07%.

The Bid to Cover of 2.77 also rebounded solidly from both last month's 2.64 and the TTM average of 2.63, and was in fact the highest since December 2014.