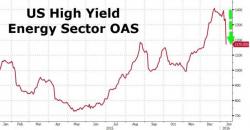

This Is The Biggest EBITDA Drop Outside Of A Recession Since 2000

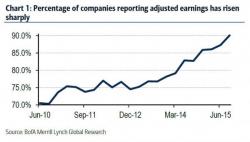

To finance professionals, EBITDA is a proxy for corporate cash flow, while Adjusted EBITDA is a proxy for telling investors whatever they want to hear. Most of the time it involves a unjustifiably high cash flow number, one which has no basis in reality.